Unlocking hidden financial networks for smarter investing

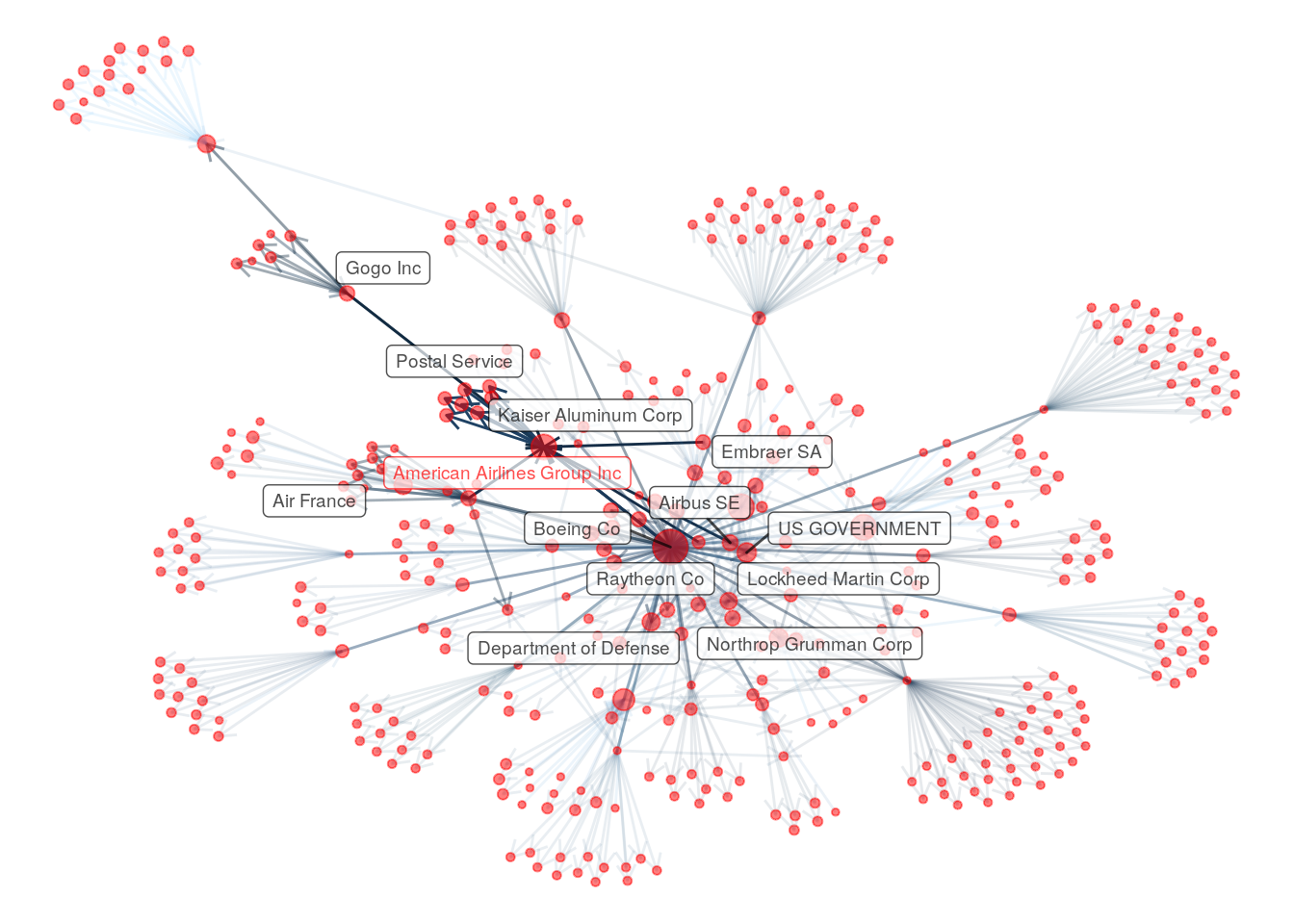

The intelligent network of how companies connect and money flows.

Trusted by leading investors, RedGraphs maps the global web of corporate relationships and money flows, revealing how dependencies and exposures shape financial markets.

Now Available on the S&P Global Platform

Snowflake | Xpressfeed

Business Relationship Analytics is now live on S&P—giving institutional investors trusted access to our AI-powered relationship analytics and capital flow intelligence.

Explore on S&P Global ➔

Trusted by Leading Financial & Data Platforms

Navigating uncertainty

For Investors

Uncover hidden alpha

The global economy is a vast, interconnected network of transactions that traditional financial models struggle to fully capture. Investors face blind spots in understanding how capital flows, which entities hold true financial influence, and where hidden risks or opportunities lie.

For Policymakers

Steering a complex system

Navigating the complexities of a globally connected economy requires data-driven insights. Policymakers need to understand intricate financial relationships and potential ripple effects to drive sustainable growth and prevent crises.

Illuminating the hidden connections

Redgraphs provides a unique, data-driven lens into the interconnected economy. Our platform leverages proprietary AI algorithms to analyze the intricate network of financial relationships between companies, revealing hidden connections and emerging trends that traditional data sources miss. We estimate hidden money flows and build a comprehensive map of the intercompany network, empowering you to:

Uncover hidden dependencies

Identify critical relationships and potential vulnerabilities within the network, allowing you to anticipate market shifts and manage risk more effectively.

Predict emerging trends

Capitalize on emerging opportunities before they become mainstream by understanding the dynamics of the intercompany network and identifying leading indicators.

Assess systemic risk

Gain a deeper understanding of interconnected risks and potential contagion effects, enabling you to build more resilient portfolios and inform policy decisions.

From relationship data to a fully characterized network

The RedGraphs advantage: More than just relationship line items

Identify hidden investment opportunities before the market

-

Traditional datasets provide relationship lists—RedGraphs quantifies and ranks financial influence.

-

Pinpoint high-impact capital flows that signal early investment opportunities.

Unmatched coverage & depth across the financial ecosystem

- Broader, deeper, and more granular data at the relationship, regional, and source levels.

- Multi-source data aggregation ensures no missing links in the economic network.

Real-time, AI-driven insights with human-verified accuracy

- While traditional platforms lag, RedGraphs delivers real-time, dynamic network updates.

- AI-powered relationship mapping combined with human-in-the-loop verification ensures unmatched accuracy.

Predict market shifts & assess financial influence with scenario modeling

- Model economic scenarios and assess financial influence across entire ecosystems.

- Perform what-if analyses to anticipate market shifts before they happen.

Quantify the strength & magnitude of financial relationships

- Go beyond who is connected—understand how much that connection matters.

- Weighted capital flow analytics reveal economic impact, dependency risks, and money movement trends.

Why thought leaders choose RedGraphs

Hedge Fund Manager (Quant Investing)

RedGraphs has transformed how we analyze capital flows. The network metrics helped us uncover hidden relationships that drive market movements, giving us a true quantitative edge in portfolio optimization.

Senior Portfolio Manager

Multi-Billion Dollar Hedge Fund

Fundamental Investor (Long-Term Strategy)

Before RedGraphs, understanding the financial influence of a company within its network was nearly impossible. Now, we can clearly see supply chain risks, capital dependencies, and hidden opportunities, allowing us to make more informed, high-conviction investments

Lead Equity Analyst

Global Asset Management Firm

Asset Manager

Understanding how companies are interconnected is crucial for risk-adjusted returns. RedGraphs helps us track supplier dependencies, financial linkages, and economic influence, allowing us to make smarter asset allocation decisions

Head of Research

Global Asset Management Firm

Quantitative Analyst (Factor & Risk Modeling)

The network-driven insights from RedGraphs have become an essential factor in our multi-factor models. It enables us to quantify systemic risk, predict capital shifts, and optimize portfolio exposures with greater precision

Senior Quantitative Analyst

Systematic Investment Fund

Quantitative Investing

Fundamental Strategy

Unlock Alpha with Customer-Supplier Momentum

RedGraphs enhances traditional momentum strategies by analyzing stock performance across supply chain relationships. Instead of looking solely at a company’s past returns, the strategy considers the stock movements of its customers and suppliers to predict future performance.

• Customer Momentum: If a company’s customers are performing well, the company itself is likely to benefit, leading to potential stock gains.

• Supplier Momentum: While less direct, strong supplier performance can indicate improved efficiencies or product quality, potentially boosting customer stock prices.

• Results: A one-month lagged customer momentum strategy delivered a Sharpe Ratio of 1.07 and an annualized CAPM alpha of 6.7%, with positive returns persisting over six- and twelve-month periods.

By leveraging RedGraphs, investors can uncover unique alpha-generating opportunities that traditional momentum strategies overlook.

Fundamental Network Strategy

Traditional fundamental investing relies on financial metrics such as P/E ratios, revenue growth, and profitability to assess a company’s value. However, capital flows and financial relationships between companies provide a deeper layer of insight often overlooked in conventional analysis.

This strategy leverages network analytics from RedGraphs to identify companies that are strategically important within the financial ecosystem.

By analyzing capital flow connectivity, this approach uncovers hidden investment opportunities that may benefit from indirect financial relationships.

The following sections provide a detailed breakdown of the strategy, including key network metrics, portfolio construction, backtesting results, and actionable insights for investors.

How Redgraphs Works

Data Ingestion

We gather vast amounts of financial data from diverse sources, including public filings, company financials, and proprietary datasets.

Network Mapping

Our AI-driven platform identifies hidden connections and financial flows.

Patented Estimation

Our models estimate missing financial flows with high accuracy, providing a complete picture.

Insight Delivery

We provide actionable insights for smarter investment strategies.

Inside the Expanding Business Network

700,000

Companies

2 Million

Financial Links

12

Network Metrics

217

Countries

74

Industries

20+

Years of History

Who Uses RedGraphs

Quantitative Investors

Uncover patterns in financial relationships to optimize trading strategies.

Fundamental Analysts

Gain deeper insights into corporate influence and supply chains.

Economic & Policy Experts

Understand macroeconomic trends through inter-company networks.

Resources

Seeing the Economy as It Really Is

Discover how RedGraphs maps the real flow of money between companies — revealing what truly drives markets, risk, and opportunity.

Read the Blog

We’ve Mapped Global Money Flows. Everyone Else Is Guessing

RedGraphs uses fine-tuned LLMs and proprietary AI to map global money flows, customer-supplier links, and risk signals before anyone else can.

Read the Blog

Introducing Strategic Role Clustering: A New Lens for Thematic Investing

In a market crowded with sector labels and style boxes, investors are increasingly looking for new sources of insight—ones that cut through traditional classifications and surface how companies actually function in the economy.

Read the Blog

Interpreting Network Analytics

A practical guide to interpreting network analytics scores—including degree centrality, eigenvector centrality, betweenness, closeness, and more. Learn how these metrics reveal a company’s strategic position in the market and power advanced clustering, influence modeling, and alpha generation.

Explore the Network Guide

How Supply Chain Shifts Shape Investment Decisions: Lessons from GM

The key insight? Companies that proactively adjust their supply networks in response to policy changes, economic shifts, and competitive pressures tend to build resilience and long-term stability—a critical factor for investors assessing risk and opportunity.

Read the Blog

How Tariffs Reshaped Supply Chains: A Network Analysis Perspective

The last Trump administration’s tariff policies triggered structural changes in global supply chains, with targeted firms adjusting significantly more than their non-targeted counterparts.

Read our Latest Analysis

Resource name

A description of the resource being shared. Just a couple of sentences should be just right.

DownloadHow do you start? Easy.

Get a data sample

We’ve created data samples consisting of sections of our entire database. If you are unsure whether Redgraphs is right for you, you can quickly see for yourself.

Chat with us

Once you see the value of Redgraphs, you can book a call to discuss your needs, how Redgraphs can meet them, and sign you up for a 30-day trial.

Integrate your data

With full access, you can download the latest data and receive daily updates. If you get stuck, our detailed guides will help you finish the job.

Start Gaining an Edge Today

Financial relationships don’t exist in isolation, yet traditional analysis treats them that way. Missing data, disconnected insights, and hidden dependencies create blind spots in decision-making. RedGraphs changes the game by using AI to map and predict these unseen connections—turning uncertainty into intelligence.